Mortgage Solutions Made For You!

Discover Mortgage Solutions Expertly Crafted to Align With Your Unique Financial Goals and Lifestyle Needs!

Discover our extensive expertise in real estate, mortgages, and more.

Explore the variety of programs we offer to help you achieve your dream of homeownership. With a range of options available, nothing is impossible when you have the determination to try. That's why we encourage you to contact us today and give our services a chance. We're here to support you every step of the way on your journey to owning a home.

Feeling confined in your apartment? Don't let those walls close in on you any longer. It's time to make a change and move into a home! Give us a call today to start the process and breathe new life into your living situation.

Don't despair! Our loan programs could be the perfect solution for you. With flexible credit requirements and low down payment options, we can help make your home ownership dreams a reality.

Mortgage Solutions! Don't wait - we have the perfect fit for you! We offer a full range of services, from VA, FHA, & conventional loans, to Fix & Flip and Foreclosure Bailout.

Make Yourself Proud.

Transitioning to a new home can feel like stepping into the unknown. Yet, amidst the uncertainty, there's a sense of excitement and possibility. As you navigate this new chapter, cling to the moments of discovery and growth. Embrace the opportunity to create a space that reflects who you are and the life you aspire to live. With each day, let your new home become a source of comfort, joy, and belonging.

Buying is more promising than renting. Get a jump on your day; contact Troy now to seize the opportunities waiting for you in the market. With his expertise and guidance, you can make informed decisions and achieve your real estate goals efficiently. Don't wait any longer take the first step towards a brighter future today.

Mastering the Mortgage Maze: A Guide to Navigating Home Financing

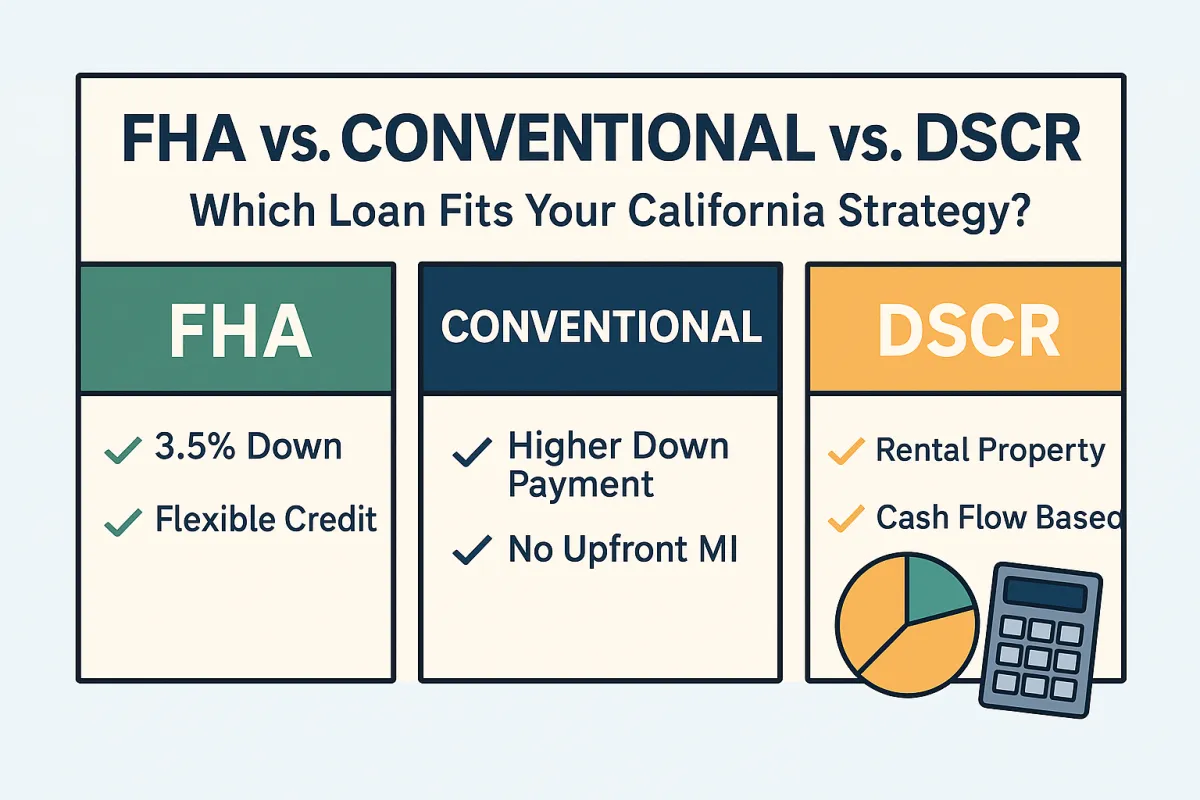

FHA vs. Conventional vs. DSCR Which Loan Fits Your California Strategy?

FHA, Conventional, or DSCR? Here’s What Actually Makes Sense in Today’s California Market

If you're trying to buy in California right now, the biggest decision isn't just the house it’s the loan you use to get it.

With rising inventory and a mixed-interest-rate environment, buyers need to structure smart from day one. So let’s break it down: FHA vs. Conventional vs. DSCR. Which is right for you?

🟩 FHA Loans (Great for First-Time Buyers or Lower FICO)

If your credit is in the 620–680 range, or your down payment is tight, FHA is still one of the most powerful tools especially in markets like Riverside, San Bernardino, and Long Beach.

Why FHA might make sense:

3.5% down payment

Flexible debt-to-income ratios

More forgiving on credit history

Seller credits allowed (great for buying down your rate)

Watch out for: Upfront mortgage insurance + monthly MI (unless you plan to refinance later).

🟦 Conventional Loans (Best for 680+ FICO and Strong Income)

If your FICO is solid and you can put at least 5 - 10% down, conventional gives you more control long term.

Why go conventional:

No upfront mortgage insurance

MI drops off once you reach 20% equity

More competitive for higher-priced homes (especially above FHA limits)

Tip: Seller credits are still allowed but often capped at 3% unless you go higher down payment.

🟧 DSCR Loans (For Investors and Self-Employed Buyers)

Not buying for your primary residence? DSCR (Debt Service Coverage Ratio) loans are built for rental property buyers or self-employed borrowers who want to qualify based on property cash flow, not personal income.

Why investors love DSCR:

No income docs needed

Qualify based on rental income

Can close in an LLC or trust

Great for short-term rentals, flips, or long-term buy & holds

Heads up: Down payments typically start at 20 - 25%, and rates are slightly higher but it’s fast money if the deal pencils.

🎯 So… What’s Your Strategy?

Choosing the right loan type isn't just about qualification it's about cash flow, risk, and long-term ownership strategy. Here's how I help:

✅ Scenario planning (real numbers, not guesses)

✅ Rate buydown vs. closing cost comparisons

✅ Real conversations not sales pitches

👇 Want clarity on your numbers?

Connect in 60 seconds, no commitment, just clarity.

🔗 Get Started

Empowering Your Homeownership Journey: Customized Mortgage Solutions for Every Step!

Discover what past clients have to say about our services.

Phil Riccobono

I'm thrilled about my new loan because Troy helped me purchase my dream home, gave me favorable terms, and now I have created a smart investment for my future.

Kim Wexler

I am overjoyed about my new loan because of Troy; he has enabled me to invest in a home that aligns with my active lifestyle. With favorable terms, I secured a space where I can pursue my passion for exercise and wellness, creating a sanctuary that supports my physical and mental well-being.

Billy Jackson

I'm so excited that I was able to facilitate my move out of state. With the specific mortgage that Troy was able to provide, I confidently transitioned to a new chapter in my life, securing a home in my desired location. This move gives me freedom, adventure, and the opportunity to explore new horizons while still feeling financially secure.

562-244-7963

© 2025 TMireBroker & Co. – All Rights Reserved Equal Housing Opportunity | Real Estate Services: TMireBroker & Co. | CA DRE: 01199870 | Private Lending: TMireBroker & Co. | Asset-Based Loans | Not a Commitment to Lend | Traditional Mortgages: | NMLS: 1795353 | Programs Subject to Change | Restrictions Apply | For Industry Use Only | No Legal Advice Provided | Loans & Real Estate Services Not Available in All States | All Offers Subject to Qualification & Applicable Laws